Fafsa Edit Number of Family Members in Household

If you have more than one kid in higher, you'll need to consider four things when filling out theCostless Application for Federal Student Aid (FAFSA®) form:

- You and each of your children demand an FSA ID.

- Each child will need to fill out a FAFSA form with parent information.

- Y'all must written report the value of your didactics savings accounts for all children combined.

- Having multiple children in college can bear upon your children'southward Expected Family unit Contribution (EFC). Read on for more than details.

ane

An FSA ID is an account username and password combination associated with your Social Security number. It serves every bit your legal electronic signature throughout the fiscal aid process. You lot AND each of your children will need your own FSA IDs.

two

Each of your children will need to make full out a FAFSA grade. Your children will need to provide your (parent) information on their 2022–23 FAFSA forms. This step isn't necessary if they are going to graduate schoolhouse, were born earlier Jan. one, 1999, or can respond "yes" to whatever of these dependency status questions.

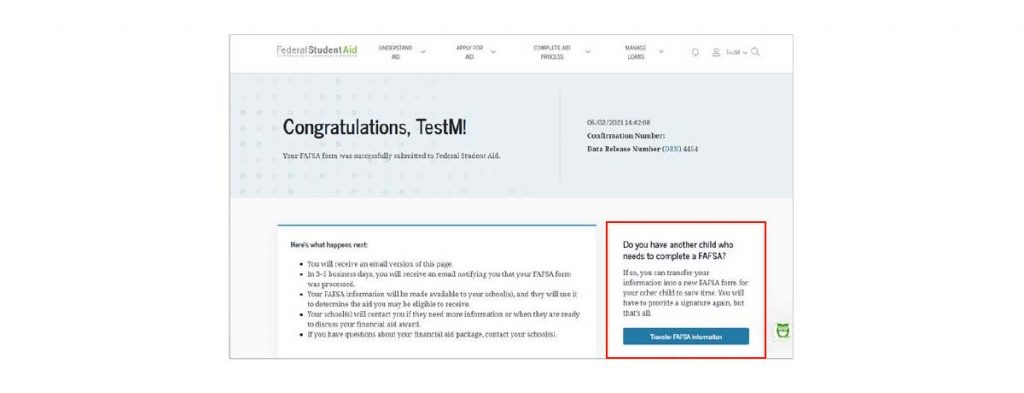

Notation:This transfer option appears when you are logged in under the parent role. The choice is available on fafsa.gov, just it is NOT currently bachelor on the myStudentAid mobile app.

TIP: If you desire the procedure to become as smoothly as possible, your second child should take his or her FSA ID on hand and so y'all're ready for the next step.

Yet, you can transfer users during one FAFSA session. After you're washed filling out the FAFSA form for ane child, select an arrow, a new window will open, and your other child will start his or her FAFSA class. Nosotros recommend that your child starts the FAFSA form by entering his or her FSA ID (not your FSA ID) using the (I am a student) option in the prototype beneath. Withal, if you are starting your kid's FAFSA course, choose the other pick (I am a parent filling out a FAFSA grade for a student), and enter your child'southward information.

Regardless of who starts the awarding from this screen, the FAFSA form remains the student'southward application; and so, when the FAFSA course says "y'all," it's referring to the student. If the FAFSA form is request for parent information, it will specify that.

Later on you select the FAFSA form, yous will consummate and create a save key. The form will take you to the introduction page, which will indicate that it copied parental information into your 2d child's FAFSA form.

In one case you lot achieve the parent information page, you will run into your data prepopulated. Verify this info, go along to sign and submit the FAFSA class, and yous're done!

three

You must report the value of all education savings accounts owned by you, your child, or any other dependent children in your household as a parent investment. (Check out "What is the net worth of your parents' investments?" FAFSA help.) If you have education savings accounts for multiple children, you lot must report the combined current value of those accounts, even if some of those children are non in college nevertheless or nonetheless completing a FAFSA form.

Example: Kid one and two are filling out the FAFSA grade. Child 3 is in 8th grade. They each take education savings accounts in their names.

- Child i account balance: $20,000

- Kid two account balance: $13,000

- Child three business relationship residue: $eight,000

You lot would add $41,000 to whatsoever other parent investments you're required to report and input information technology when asked, "What is the internet worth of your parents' investments?" on each of your children's FAFSA forms.

four

Multiple children enrolled in higher at the aforementioned time could impact your children's eligibility for need-based federal financial aid.

Don't ever assume your child won't qualify for aid, particularly if they didn't qualify the previous year.This is a huge mistake, particularly if you will have additional children entering college.

Schools employ the following formula to determine how much aid your child is eligible to receive.Cost of attendance (COA) – Expected Family Contribution (EFC) = financial need

Permit's suspension downwards this formula:

- CO A :This will vary by school, and so if you take two children attending dissimilar schools with dissimilar costs, their financial need may be different, even if their EFC is the same.

- EFC: The information you provide on the FAFSA form is used to summate your child's Expected Family unit Contribution (EFC). Since we recognize that as a parent, your almanac power to pay per child decreases as you have more than children enroll in college, we divide the expected parent contribution portion by the number of children you await to have in college. This is how much you are expected to contribute.

Example: Allow'south assume that all your dependent children have identical financial information and that the calculated EFC with one child in college would be $10,000. Here's how each child's EFC would modify depending on the number of family members attention higher full-time.

- Financial need: Schools differ (sometimes profoundly) in their ability to come across each student'due south fiscal need. To compare boilerplate school costs, visit the College Scorecard.

lilienthallogetch39.blogspot.com

Source: https://studentaid.gov/articles/fafsa-multiple-children/

0 Response to "Fafsa Edit Number of Family Members in Household"

Post a Comment